Commerce

BCom Taxation: Complete Guide on Course, Jobs, Salary, and Future Scope

Choosing the right course after school is important. It helps shape your future. This guide is about BCom Taxation. It is an interesting course for students who enjoy finance and tax laws. You will learn what this course is, who should study it, and when to start.

- What is BCom Taxation?

- BCom Taxation Course Objectives

- BCom Taxation: Course Highlights:

- BCom Taxation Course Duration

- BCom Taxation Course Eligibility

- BCom Taxation Course Admission Process

- Top Entrance Exams for BCom Taxation in India

- BCom Taxation Course Fees in India

- BCom Taxation: Subjects & Syllabus

- Why BCom Taxation is Important

- Salaries After BCom Taxation Degree

- Future Scope of BCom Taxation in India

- Careers Opportunities After BCom Taxation Degree

- Top Companies Hiring BCom Taxation Graduates

- Essential Skills for BCom Taxation Graduates

- Certificate Courses After BCom Taxation

- BCom Taxation vs. BCom General - Which One to Choose?

- Top Colleges in India for BCom Taxation

- Top FAQs:

- Key Takeaways from BCom Taxation

What is BCom Taxation?

BCom Taxation is a degree in commerce. It teaches about tax laws, financial rules, and business regulations. Students learn how taxation works in different businesses.

This course also helps them understand income tax, GST, and company tax rules. Since every business must follow tax laws, this knowledge is very useful.

Moreover, the course is great for students who like numbers, finance, and legal rules. It teaches how to calculate taxes, prepare tax returns, and follow tax rules. Many companies, in fact, hire taxation experts to handle their money.

Who Should Study BCom Taxation?

BCom Taxation is best for students who:

-

Like working with numbers and solving problems.

-

Have an interest in finance, business, and tax laws.

-

Want a career in banking, accounting, or financial planning.

-

Enjoy logical thinking and making financial decisions.

If you are interested in managing business money, this course is a great choice. It shows how companies pay taxes and follow tax rules.

When to Pursue BCom Taxation? Students can start BCom Taxation after passing 12th grade. It is a smart option if you like finance and taxation.

By choosing this early, you can build strong knowledge. This course gives a strong base in business and finance. As a result, it gets you ready for jobs in taxation and accounting.

Why Choose BCom Taxation?

-

High demand – Businesses need tax experts for their work.

-

Good salary – Tax experts earn well.

-

Diverse career options – Work in banks, finance firms, or as a tax consultant.

-

Further studies – You can also do CA, CMA, or MBA after this course.

In conclusion, BCom Taxation is a smart course for students who enjoy finance and tax rules. It gives useful knowledge and also opens doors to many careers. If you like solving tax problems, this course is a great start.

BCom Taxation Course Objectives

BCom Taxation is a focused course. It teaches students about tax laws, financial rules, and business regulations. Moreover, it prepares them for a career in taxation and finance. Let’s now explore its objectives and duration.

BCom Taxation Course Objectives

The main goals of this course are:

-

Knowing tax laws and financial rules in India.

-

Learning tax planning, compliance, and financial reporting.

-

Developing problem-solving and critical thinking skills.

-

Using taxation software and digital tools for tax work.

-

Knowing ethical and legal aspects in taxation.

-

Building knowledge in GST, income tax, and corporate tax.

-

Gaining practical knowledge through projects and case studies.

-

Getting ready for jobs in banking, finance, and auditing.

This course is not only about numbers. It also helps students think clearly and make smart financial decisions. As a result, they understand taxes in a better way.

Furthermore, by learning these topics, students become confident and job-ready. Therefore, BCom Taxation is a smart course for anyone who wants to work in finance, accounts, or taxation.

BCom Taxation: Course Highlights:

| Full Form | BCom Taxation |

| Course Level | Undergraduate |

| Course Duration | 3 years |

| Eligibility | 10+2 in Commerce stream |

| Course Fee | INR 50,000 – 2,00,000 (approx.) |

| Examination Type | Semester-based |

| Admission Process | Merit-based or Entrance Exam |

| Average Salary After Degree | INR 3,00,000 – 6,00,000 per annum (approx.) |

| Recruiting Companies After Degree | Deloitte, PwC, EY, KPMG, HDFC, ICICI, etc. |

BCom Taxation Course Duration

BCom Taxation is a 3-year UG program. Each year, students learn new topics in finance, accounting, and tax laws. The course divides into six semesters, covering:

-

First Year: Basics of commerce, accounting, and tax principles.

-

Second Year: Detailed study of tax laws, GST, and financial planning.

-

Third Year: Advanced taxation, auditing, and practical applications.

During this time, students grow from beginners to skilled professionals. The course structure helps them build a solid knowing of taxation. It prepares them for challenges they will face in the real world.

BCom Taxation Course Eligibility

BCom Taxation is a course many students choose if they are interested in taxes. It includes topics like finance and accounting. Before applying, you should know the eligibility criteria. It’s important to understand the admission process.

BCom Taxation Course Eligibility Criteria

To join a BCom Taxation program, students must meet certain basic requirements:

-

Academic Qualification – Students must pass Class 12 from a recognised board.

-

Stream – Most colleges prefer students from the commerce stream.

-

Marks – Many colleges need 45% to 50% marks in Class 12.

-

Required Subjects – Knowing accounting, business, and economics is useful. It can help you in many situations.

-

Entrance Exam – Some universities conduct entrance tests before admission.

Students should check specific college requirements before applying. Having a strong foundation in commerce makes the learning process easier.

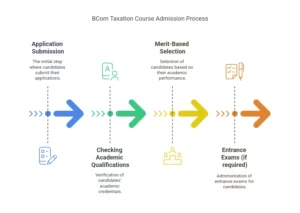

BCom Taxation Course Admission Process

Getting admission to a BCom Taxation program is simple. However, students must follow the steps carefully. This helps them stay ready at every stage.

- Application Submission:

- First, students must fill out an application form, either online or offline.

- The form asks for your personal details, marks, and other important information.

- So, you must read the form properly before filling it out.

- Checking Academic Qualifications:

- Next, colleges check your 10+2 exam results before giving admission.

- Usually, higher marks in commerce subjects help you get selected easily.

- Merit-Based Selection:

- After checking marks, many colleges prepare a merit list.

- Students with better scores get admission first.

- So, scoring well in Class 12 becomes very helpful.

- Entrance Exams (if required):

- Some colleges or universities may have entrance exams.

- These tests check your knowledge in commerce, like reasoning, accounting, or business studies.

- Therefore, students must prepare well if entrance exams are part of the process.

BCom Taxation is a great course for students who love finance and taxation. So, knowing the admission process early helps you plan better. With good preparation, you can get into a top college. As a result, your journey becomes smooth and simple.

Top Entrance Exams for BCom Taxation in India

To get into a BCom Taxation course, many universities in India hold entrance exams. These exams check your skills in commerce subjects. So, clearing them helps you get into top colleges.

Popular Entrance Exams for BCom Taxation

Although different colleges have different exams, below are some of the most common ones:

DU JAT (Delhi University Joint Admission Test)

- This exam is conducted by Delhi University.

- It includes subjects like Mathematics, Business Studies, and English.

- It is needed if you want to join DU colleges that offer BCom Taxation.

SET (Symbiosis Entrance Test)

- This exam is held by Symbiosis International University.

- It tests your analytical skills, English, and quantitative ability.

- It is important for getting into Symbiosis colleges.

IPU CET (Indraprastha University Common Entrance Test)

- This test is conducted by Guru Gobind Singh Indraprastha University.

- It includes questions from English, Mathematics, and Accounting.

- You need it for admission to IP University colleges.

BHU UET (Banaras Hindu University Undergraduate Entrance Test)

- This exam is conducted by Banaras Hindu University.

- It checks your knowledge in commerce-related subjects.

- It is required to study BCom programs at BHU.

As you can see, choosing the right entrance exam depends on your preferred college. So, you must check each college’s rules. After that, you can prepare well and do your best. With good planning and study, it becomes easier to pass the exam and get admission.

BCom Taxation Course Fees in India

Knowing the course fees is vital before applying for a BCom Taxation degree. The fees vary from one college to another.

Average Course Fees

-

The course fees range from INR 50,000 to INR 3,00,000.

-

Fees depend on factors like:

-

Type of college – Private colleges charge more than government colleges.

-

College reputation – Well-known universities have higher fees.

-

Facilities offered – Libraries, labs, and hostel facilities add to costs.

-

Additional Expenses

Apart from tuition fees, students may have to pay for:

-

Hostel and food expenses (if staying in college accommodation).

-

Books and study materials for different subjects.

-

Exam and admission fees during the application process.

Financial Planning

Students should plan their finances before enrolling. Some colleges offer scholarships based on merit or financial need. Checking for education loans can also help reduce the financial burden.

Knowing the total costs helps students plan. This way, they can begin their BCom Taxation journey with confidence.

BCom Taxation: Subjects & Syllabus

It is very important to understand the subjects and syllabus of BCom Taxation. This course teaches students about taxation, finance, and business laws. It includes both theory and practical learning. So, students can gain real and useful knowledge.

Main Subjects:

Students learn many subjects that are linked to taxation and finance. Some of the main ones are:

- Income Tax Laws – Learn about tax slabs, exemptions, and deductions.

- Corporate Tax Planning – Understand how companies plan and manage taxes.

- Goods and Services Tax (GST) – Study GST rules, calculations, and payments.

- Accounting Basics – Learn how to keep financial records and make reports.

- Business Law and Ethics – Know about laws and ethics in the world of business.

Optional Subjects:

Along with the main ones, students can also choose some optional subjects. These depend on their interest and goals:

- International Taxation – Understand how global businesses follow tax rules.

- Wealth Tax – Learn about tax on property, assets, and savings.

- E-commerce Taxation – Know how taxes work on online shopping and digital money.

Practical Learning:

This course is not only about books. It also gives students a chance to learn by doing. For example:

- Case studies – Solve real tax problems in class.

- Internships – Work with experts to get real job experience.

- Workshops – Learn about tax filing and financial planning step by step.

By learning these subjects, students build a strong base in taxation. They also grow their knowledge in finance. As a result, they are ready to handle real-life money matters with ease.

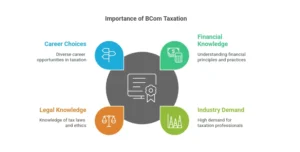

Why BCom Taxation is Important

BCom Taxation is more than just a course. It helps students understand finance, business laws, and tax rules in a very simple way. Moreover, the knowledge learned in this course is useful in many real-life jobs. It not only builds skills but also prepares students for a strong career.

Key Benefits:

Strong Financial Knowledge

- Students learn about accounting, tax laws, and financial reports.

- As a result, they can manage money and business work in a better way.

High Industry Demand

- Today, tax experts are needed in companies, banks, and consulting firms.

- This course helps students support business decisions and do tax planning.

Legal Knowledge and Ethics

- Students get to learn about government rules and tax laws.

- They also learn to handle work with honesty and responsibility.

Many Career Choices

- After this course, students can work as tax consultants, financial analysts, or corporate tax planners.

- They can also start their own tax advisory business and help others.

Therefore, Bachelor of Commerce in Taxation is a smart choice. It not only builds knowledge but also opens doors to many great job options. It truly helps students become finance experts in the future.

Salaries After BCom Taxation Degree

After finishing their BCom in Taxation, students receive strong job offers. These opportunities are in the finance and tax sectors. The salary depends on experience, skills, and the company.

Expected Salary Range:

-

Freshers – Earn INR 3 to 6 lakhs per year in entry-level jobs.

-

Experienced Professionals – Can earn higher salaries with time and skill.

Job Roles & Salary:

-

Tax Analyst

-

Help companies manage tax records.

-

Starting salary: INR 3 to 4 lakhs per year.

-

-

Financial Consultant

-

Advises on tax planning and financial savings.

-

Starting salary: INR 4 to 6 lakhs per year.

-

-

Corporate Tax Manager

-

Handles tax planning for big companies.

-

Salary: INR 8 to 12 lakhs per year.

-

A career in taxation gives stable jobs and high salaries. With experience, earnings increase over time.

Future Scope of BCom Taxation in India

A BCom Taxation degree opens many career opportunities. These opportunities exist in the government, private, and international sectors. The need for tax professionals is growing. Students can look into various jobs in finance and taxation.

Scope in Government & Private Sectors

-

Government Jobs

-

Work in Income Tax Department, Customs, and Ministry of Finance.

-

Positions include Tax Inspector, Revenue Officer, and Auditor.

-

Competitive exams help secure these jobs.

-

-

Private Sector Jobs

-

Companies need tax experts, auditors, and financial consultants.

-

Work in corporate finance, investment firms, and tax advisory companies.

-

Start as an analyst and grow into senior roles.

-

Global Career Options

-

International taxation is growing. Many companies need experts in cross-border tax rules.

-

There are jobs in big companies, international banks, and consulting firms. Many opportunities are available in these fields.

-

Professionals work in international tax planning and compliance.

A career in taxation is stable and rewarding. With experience, students earn high salaries and take on bigger roles.

Careers Opportunities After BCom Taxation Degree

After BCom Taxation, students can work in tax planning, auditing, and financial management. Jobs are available in government and private sectors.

Top Career Options:

-

Tax Analyst

-

Helps businesses follow tax laws and reduce tax costs.

-

Works in corporate companies, banks, and consulting firms.

-

-

Financial Consultant

-

Gives advice on investments, money management, and tax planning.

-

Works in banks, investment firms, and business advisory services.

-

-

Corporate Tax Manager

-

Handles tax planning and compliance for companies.

-

Helps businesses follow tax laws and save money.

-

-

Auditor

-

Checks financial records to ensure accuracy and compliance.

-

Works in government agencies, banks, and private companies.

-

-

Tax Compliance Officer

-

Ensures businesses follow tax rules and regulations.

-

Works in government tax departments and financial institutions.

-

Government & Private Job Opportunities

-

Government Jobs

-

Work in Income Tax Department, Excise, and Finance Ministry.

-

Positions include Tax Inspector, Auditor, and Revenue Officer.

-

-

Private Sector Jobs

-

Work in corporate finance, tax consultancy, and investment firms.

-

Roles include Financial Analyst, Tax Consultant, and Investment Advisor.

-

A BCom Taxation degree offers many career paths. Students can work in tax planning, financial consulting, or auditing. With experience, salaries increase, and job roles improve.

Top Companies Hiring BCom Taxation Graduates

Many companies hire Bachelor of Commerce in Taxation graduates for roles in finance. They hire them for tax consulting and auditing jobs. Some top companies offer great opportunities in these fields.

-

Deloitte

-

A global leader in finance and tax consulting.

-

Hire graduates for roles in tax advisory and financial analysis.

-

-

PricewaterhouseCoopers (PwC)

-

Well known for audit and assurance services.

-

Offer jobs in tax strategy, compliance, and corporate finance.

-

-

Ernst & Young (EY)

-

A multinational company offering tax consulting and advisory services.

-

Hire graduates for tax planning and financial risk management.

-

-

KPMG

-

Specializes in tax, audit, and advisory services.

-

Provide jobs in corporate tax planning and financial consulting.

-

-

Grant Thornton

-

Works in audit, tax, and financial advisory.

-

Offers roles in tax compliance and financial management.

-

-

Kotak Mahindra Bank

-

A well-known bank hiring graduates for finance and taxation roles.

-

Offer jobs in corporate tax, financial auditing, and tax planning.

-

-

Reliance Industries

-

A large business group with many financial departments.

-

Offers jobs in tax compliance and investment planning. It includes opportunities in auditing.

-

These companies offer decent salary packages. They assist graduates in developing solid careers in finance and taxation.

Essential Skills for BCom Taxation Graduates

To do well in a BCom Taxation course, students need to build some important skills. These skills not only help in handling money and taxes but also make the job easier. With the right skills, students can work better and grow faster.

Analytical Thinking:

- Helps understand financial data in a smart way.

- Often used in tax calculation and making business plans.

Attention to Detail:

- Makes sure all tax papers are correct.

- Also helps reduce mistakes in audits and filings.

Communication Skills:

- Useful when talking about tax rules and money plans.

- Helps in working with clients, companies, and officers.

Problem-Solving Ability:

- Helps fix any tax problems quickly.

- Also useful for making smart money decisions.

Ethical Judgement:

- Helps follow honest tax practices.

- Prevents cheating and supports government rules.

Financial Software Knowledge:

- Helps use accounting software with ease.

- Also saves time during tax work.

Time Management:

- Helps finish work before deadlines.

- Very useful during tax season or audit time.

Therefore, by learning these essential skills, BCom Taxation students can grow into smart tax experts. They can work in top finance companies and build a strong future in tax planning.

Certificate Courses After BCom Taxation

After completing a BCom Taxation degree, students can choose from many useful certificate courses. These courses not only help them learn more about finance, taxation, and accounting, but also improve their chances of getting better jobs. In fact, each course adds extra value to their learning.

Certificate in International Taxation

-

Teaches about global tax laws.

-

Helps in understanding cross-border finance and tax rules.

-

Useful for jobs in international companies.

Diploma in GST (Goods and Services Tax)

-

Focuses on India’s GST laws and rules.

-

Prepares students to become tax consultants or accountants.

-

Also helps in small and large business work.

Certification in Forensic Accounting

-

Helps in finding financial fraud.

-

Combines accounting with smart investigation skills.

-

Good for those who enjoy solving money problems.

Diploma in Financial Planning

-

Teaches how to manage personal and business money.

-

Guides students to create strong financial plans.

-

Useful in both home and office settings.

Certificate in Transfer Pricing

-

Explains pricing between related companies.

-

Helps in tax planning for big and global companies.

-

Makes students ready for international tax jobs.

Certificate in Business Taxation

-

Covers corporate tax laws and company rules.

-

Helps in working at tax firms or in the corporate world.

-

Also builds a strong base for future studies.

Diploma in Banking and Finance

-

Focuses on banking laws, money markets, and investments.

-

Prepares students for jobs in banks and financial firms.

-

Very helpful for careers in the finance sector.

By choosing the right certificate course, students can grow their skills and find great job opportunities in the future.

BCom Taxation vs. BCom General – Which One to Choose?

Both BCom Taxation and BCom General offer good career options. But, they have different focus areas.

Why Choose BCom Taxation?

-

Specialized in Taxation

-

Teaches about tax laws, accounting, and financial regulations.

-

Best for students interested in tax and finance jobs.

-

-

More Job Opportunities in Taxation

-

Helps in careers like tax analyst, financial auditor, and GST consultant.

-

Useful for working in companies and government tax offices.

-

-

High Industry Demand

-

Businesses need tax experts for legal tax filing.

-

Many banks, companies, and tax firms hire BCom Taxation graduates.

-

-

Good for Higher Studies

-

Helps in pursuing CA, CMA, or MBA in Finance.

-

Best for students who want to specialize in finance.

-

Why Choose BCom General?

-

Covers Many Subjects

-

Includes finance, marketing, and management.

-

Best for students who want a broader business knowledge.

-

-

More Career Choices

-

Can work in banking, marketing, HR, and business management.

-

Flexible degree with many job options.

-

-

Good for Entrepreneurship

-

Helps in learning business strategies and management.

-

Useful for students who want to start their own business.

-

-

Better for Competitive Exams

-

Covers topics useful for banking and government job exams.

-

Helps in preparing for MBA, UPSC, or SSC exams.

-

Which One is Better?

-

Choose BCom Taxation if you like finance, tax laws, and accounting.

-

Choose BCom General if you want a wider choice of careers in business.

Both degrees offer good jobs. The best choice depends on your career interest and future goals.

Top Colleges in India for BCom Taxation

Many good colleges in India offer the Bachelor of Commerce (BCom) in Taxation. These colleges give quality education and also help students build a strong future in finance and taxation.

- Loyola College, Chennai is one of the best commerce colleges. It offers a well-structured BCom Taxation course with expert teachers.

- Christ University, Bangalore is also a good choice. It provides excellent training in taxation and finance. The college also offers internships and job support.

- St. Xavier’s College, Kolkata is very popular for its strong commerce courses. It covers all topics in tax and finance, so students gain full knowledge.

- Narsee Monjee College, Mumbai is another top college. It offers practical training and real industry exposure.

- Madras Christian College (MCC), Chennai teaches accounting, finance, and tax laws in detail. Students also learn with the help of real-life examples.

- Hindu College, Delhi gives students both theory and practical knowledge. It is a part of Delhi University, so it has a good name.

- Symbiosis College, Pune also gives a strong base in finance. It helps students with placements after the course.

- Jain University, Bangalore focuses on job-ready skills. It also offers a full taxation course.

- Mount Carmel College, Bangalore is good for girls. It teaches all major tax laws.

- Amity University, Noida gives modern learning. It includes case studies and training.

So, choosing the right college is important. A good college helps you get a good job in the tax and finance field.

Top FAQs:

BCom Taxation is a course that lasts three years. It covers tax laws, finance, and accounting.

This course includes income tax, GST, and accounting. Besides these, it also covers business law and financial management. So, students learn both theory and practical topics.

Students need to complete 12th grade from a recognised board. It is best if they study commerce or mathematics.

If you like learning about tax laws, then BCom Taxation is a good choice. On the other hand, BCom General gives a wider view of business subjects.

After this course, students can become tax consultants, accountants, or auditors. Moreover, they may also work as financial analysts in companies.

Yes, you can. In fact, BCom Taxation is helpful for students who want to prepare for CA, CS, or CMA exams. It gives a strong base in finance.

Top colleges include Loyola College, Christ University, St. Xavier’s College, and Narsee Monjee College.

Generally, the starting salary is around ₹3 to 6 lakh per year. But it can increase with more skills and experience.

The course is not hard if you have interest in finance and tax laws.

Yes, you can apply for bank jobs and tax officer roles. Besides that, you can also take part in other government exams.

Key Takeaways from BCom Taxation

A BCom Taxation degree is a smart choice for students. It helps them get ready for a good career in finance and taxation. To begin with, picking a good college is very important. A good college helps students learn better and also gives better job placements.

After completing Bachelor of Commerce Taxation, students can study more. They can go for CA, CMA, MBA, or other finance courses. So, higher studies can lead to better career growth and more chances to get top jobs in the future.

Later on, graduates can find jobs in many fields. They can become tax consultants, accountants, or financial analysts. In fact, many companies, banks, and government offices hire students who know about taxation and finance.

In short, a BCom Taxation degree gives a strong base in finance. It also offers many chances in taxation, accounting, and business. Because of this, students can choose from many career paths and build a bright future.

-

Entrance Exam11 months ago

Entrance Exam11 months agoNEET Seats in India 2025: A Simple Guide

-

Engineering1 year ago

Engineering1 year agoTop 10 Engineering Colleges in Pune – NIRF Ranking, Admission, Courses, Placements

-

BBA1 year ago

BBA1 year agoWhat is BBA Aviation Degree: Course, Subjects, Eligibility, Admission, Scope, Salary, Career, Jobs

-

Agriculture12 months ago

Agriculture12 months agoBSc Agriculture: Complete Guide to Course, Colleges, Jobs & Salary in India

-

How To9 months ago

How To9 months agoHow to Become a Lawyer: A Step-by-Step Guide to Building a Successful Legal Career

-

News11 months ago

News11 months agoNEST 2025 Registration Live Updates: Know Dates, Process, Fees, Documents

-

Entrance Exam6 months ago

Entrance Exam6 months ago10 Must Read Books to Ace CLAT Preparation: The Ultimate Guide

-

Management12 months ago

Management12 months agoMBA in International Business: Course Details, Colleges, Fees, and Career Scope