Commerce

BCom Accounting Degree: Course, Subjects, Eligibility, Admission, Scope, Salary, Career, Job Opportunities

Choosing the right course after school is important. If you like numbers and finance, BCom Accounting is a great choice. This guide will explain what BCom Accounting is and its importance. It will tell you who should study it.

- What is BCom Accounting?

- BCom Accounting Course Objectives

- BCom Accounting: Course Highlights

- BCom Accounting Course Duration

- BCom Accounting Course Eligibility Criteria

- BCom Accounting Course Admission Process

- Top Entrance Exams for BCom Accounting Degree in India

- BCom Accounting Course Fees

- BCom Accounting: Subjects & Syllabus

- Why Studying BCom Accounting is Important?

- Salary after BCom Accounting Course in India

- Future Scope of BCom Accounting Degree in India

- Career and Job Opportunities after BCom Accounting Degree

- Top Companies Hiring BCom Accounting Graduates

- Important Skills for BCom Accounting Degree

- Certificate Courses after BCom Accounting

- BCom Accounting or BCom Finance – Which is Better?

- How to Choose a Top BCom Accounting College?

- Top Colleges in India for BCom Accounting

- Frequently Asked Questions (FAQs):

- Key Takeaway

What is BCom Accounting?

BCom Accounting is a three-year undergraduate course. It teaches students about accounting, taxation, auditing, and finance. Because of this course, students learn how businesses manage money. So, they get ready for jobs in finance and accounting.

This course is not only about numbers. It also focuses on financial planning, business rules, and using accounting software. These skills are very helpful. Therefore, students can build a strong career in finance.

Why is BCom Accounting Important? Every business must track income and expenses. That is why accounting is very important. So, businesses need accountants to follow financial rules and make smart decisions.

This course helps students in many ways:

- Number Skills – It helps students work with money and data

- Problem-Solving Ability – It teaches how to check and understand financial records

- Attention to Detail – It helps in finding mistakes in accounts

- Understand Business – It gives clear knowledge of company finances

Who Should Choose BCom Accounting? BCom Accounting is a good choice for students who:

- Like working with numbers and data

- Want a job in finance, banking, or auditing

- Enjoy solving problems and reading business reports

- Are interested in tax laws and financial rules

If you like these things, then this course is perfect for you.

When Should You Study BCom Accounting? You can join this course after 12th grade. So, if you want a job in accounting or finance, it is better to start early. This course helps you learn the right skills at the right time.

Also, BCom Accounting gives a strong base for higher studies like CA, CMA, or MBA. As a result, it opens many career options in India and abroad.

BCom Accounting Course Objectives

The BCom Accounting course teaches important finance skills. It prepares students for a career in accounting. The course focuses on both technical knowledge and problem-solving abilities.

Key Objectives of BCom Accounting

- Accounting Basics: First, students learn to record transactions and prepare balance sheets. This helps them understand a company’s financial position.

- Financial Analysis: Next, the course teaches how to study financial reports. This is useful because it helps in making smart business decisions.

- Auditing Skills: Students also learn how to check company accounts for mistakes or fraud. This is important because it ensures financial accuracy and trust.

- Problem-Solving: In this course, students develop logical thinking. This is useful when handling financial challenges in businesses.

- Taxation Knowledge: Students also learn about tax laws. They learn how to calculate taxes. This is useful for tax consulting jobs or accounting firms.

- Accounting Software: Tools like Tally, QuickBooks, and Excel help students work more quickly. These tools are also widely used in offices.

- Business Ethics: Students learn the value of honesty and fairness in finance. This helps them follow legal rules and maintain trust.

Overall, this course prepares students for careers in banking, auditing, taxation, and finance. It also builds a strong foundation for future growth in the accounting field.

BCom Accounting: Course Highlights

Course Highlights:

| Full Form | BCom Accounting |

| Course Level | Undergraduate |

| Course Duration | 3 years |

| Eligibility | 10+2 in Commerce stream |

| Course Fee | INR 50,000 – 2,00,000 (approx.) |

| Examination Type | Semester-based |

| Admission Process | Merit-based or Entrance Exam |

| Average Salary After Degree | INR 3,00,000 – 6,00,000 per annum (approx.) |

| Recruiting Companies After Degree | Deloitte, PwC, EY, KPMG, HDFC, ICICI, etc. |

BCom Accounting Course Duration

The BCom Accounting course takes three years to complete. These three years help students build strong accounting skills. Many universities split the course into six parts. Students take exams at the end of each part.

Learning Stages:

-

First Year – It covers basic topics such as financial accounting and business studies. It includes economics. This builds a strong foundation in commerce.

-

Second Year – Covers advanced subjects such as auditing and cost accounting. It includes company law. Students learn how businesses manage money.

-

Final Year – Covers training in taxation, banking, and finance. This prepares students for real-world challenges.

The structured approach ensures students gain deep knowledge of commerce and finance. It makes them ready for jobs in accounting and related fields.

BCom Accounting Course Eligibility Criteria

Students must meet some basic requirements to join the BCom Accounting course. Knowing these rules helps in choosing the right path early.

Who Can Apply?

To get admission, students need the following:

- Academic Qualification

First of all, students must pass Class 12 from a recognized board. Usually, students from the commerce stream are given preference.

- Marks Required

Most colleges ask for 45% to 50% marks in Class 12 exams. However, some top colleges may have higher cut-off marks. So, students must check before applying.

- Commerce Background

It is better if students have studied accounting, business, or economics. Also, knowing some basic mathematics can be a plus point.

- Entrance Exams (if any)

In addition, a few colleges may conduct their own entrance exams. So, students must prepare for that as well.

Therefore, if you meet these rules, your admission process will be smooth and simple. Most importantly, always check the college’s own criteria before filling the form.

BCom Accounting Course Admission Process

To join a BCom Accounting course, students need to follow a simple process. First, they must meet the required criteria. Then, they must complete the necessary steps to apply.

Admission Steps:

The admission process may be slightly different for each college. However, most colleges follow these common steps:

- Application Form – First, students fill out an application form. These forms are available either online or offline. Students can find them on the college websites or in the campus offices.

- Merit-Based Selection – Many colleges select students based on their Class 12 percentage. Cut-off marks vary for each college, so students should check carefully.

- Entrance Exams – Some colleges may conduct entrance exams. These exams test the knowledge of students in commerce subjects.

- Counseling Process – After the entrance exams, shortlisted students may need to attend counseling sessions. During counseling, colleges help students choose the best subjects based on their interests and goals.

- Personal Interview – In some cases, colleges conduct a brief interview. This interview helps colleges understand student interests, goals, and career plans.

Remember, each college may have its own rules. Therefore, students should always check the details before applying.

Top Entrance Exams for BCom Accounting Degree in India

Some colleges need students to pass entrance exams for admission. These exams test knowledge in commerce, reasoning, and English.

Popular Entrance Exams

-

DU JAT (Delhi University Joint Admission Test)

-

Conducted by Delhi University for various commerce courses.

-

Tests skills in math, reasoning, English, and business knowledge.

-

-

SET (Symbiosis Entrance Test)

-

Held by Symbiosis International University for BCom Accounting.

-

Exam covers English, math, and analytical skills.

-

-

IPU CET (Indraprastha University Common Entrance Test)

-

Organized by Guru Gobind Singh Indraprastha University.

-

Tests English, general knowledge, and reasoning skills.

-

-

CUET (Common University Entrance Test)

-

The National Testing Agency (NTA) runs the tests. These tests are for admission to central universities.

-

It has parts on language, maths skills, reasoning, and business subjects. The explanation of each topic is clear.

-

-

NMIMS NPAT (Narsee Monjee Institute of Management Studies – National Test for Programs After Twelfth)

-

Held by NMIMS University for UG commerce courses.

-

Tests math, logical reasoning, and language skills.

-

These exams help students get into top colleges. Preparing well increases the chance of selection.

BCom Accounting Course Fees

BCom Accounting demands academic preparation and financial planning. Course fees fluctuate based on college reputation, faculty, and facilities.

Understand Fees Structure

-

The fees range from INR 50,000 to 2,00,000 for the full course.

-

Government colleges have cheaper fees. Private colleges may charge higher fees.

-

Some colleges give scholarships. These are based on merit or financial need.

-

Extra costs are for books, exam fees, and hostel fees. These apply if you are living on campus.

Before selecting a college, look at the costs and the quality of education. This will help you make a good choice.

BCom Accounting: Subjects & Syllabus

The BCom Accounting syllabus focuses on finance and business. It focuses on taxation as well. These subjects help students build a strong foundation in accounting.

Core Subjects

-

Financial Accounting

-

Learning how to record financial transactions and prepare financial statements.

-

Helps businesses track income and expenses.

-

-

Cost Accounting

-

Understand how to calculate costs and create budgets.

-

Helps in controlling expenses and making business decisions.

-

-

Corporate Accounting

-

Learning about company accounts, including mergers and financial reports.

-

Important for working in large businesses and finance firms.

-

-

Taxation

-

Understand income tax, GST, and corporate tax rules.

-

Helps in filing tax returns and managing business taxes.

-

-

Auditing

-

Checking financial records to ensure they are correct and legal.

-

Important for detecting fraud and errors.

-

-

Business Law

-

Learning about business rules, contracts, and legal rights.

-

Helps to understand trade laws and company policies.

-

-

Business Mathematics and Statistics

-

Using math and data analysis in finance.

-

Important for making business predictions and reports.

-

-

Economics

-

Understand how markets and businesses work.

-

Helps in making financial decisions.

-

-

Financial Management

-

Learning how to manage money, investments, and company funds.

-

Important for business growth.

-

-

Business Communication

-

Developing speaking and writing skills for the business world.

-

Helps in professional communication.

The BCom Accounting syllabus teaches students about finance and accounting. It gets them ready for business management careers.

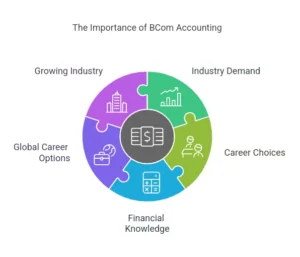

Why Studying BCom Accounting is Important?

A BCom Accounting degree is more than just a course. It leads to a strong career and helps students become ready for top business jobs.

Let’s look at why studying BCom Accounting is so important.

Key Reasons to Study BCom Accounting

- Industry Demand

Businesses are always looking for skilled accountants to manage their money. Companies in almost every industry need accounting experts to help them succeed.

- Many Career Choices

With a BCom Accounting degree, students have many job options in the finance field. They can work as accountants, auditors, tax consultants, or finance managers. This degree also opens the door to jobs in different industries like banking, finance, and corporate firms.

- Strong Financial Knowledge

The course teaches students how to manage money and look at budgets. It helps students make smart financial choices. These skills are useful for both job success and managing personal finances.

- Global Career Options

The BCom Accounting degree is recognized worldwide. So, graduates can choose to work in India or even abroad.

- Growing Industry

As businesses keep growing, they need more help with money management. That’s why accounting experts are always in demand.

Moreover, the field keeps changing because of new laws and technology. So, professionals in accounting must keep learning and improving their skills.

A BCom Accounting degree equips students with essential finance skills. It opens up many career opportunities for them, both in India and around the world.

Salary after BCom Accounting Course in India

After finishing BCom Accounting, students can find good jobs. These jobs provide a steady income. The salary depends on experience, skills, and the company. Let’s look at the salary details.

Salary Range by Experience

-

Entry-Level (0-2 years)

-

Salary: INR 3,00,000 – 5,00,000 per year.

-

Common jobs: Accountant, Junior Auditor, Tax Assistant.

-

-

Mid-Level (3-5 years)

-

Salary: INR 6,00,000 – 8,00,000 per year.

-

Common jobs: Financial Analyst, Account Manager, Tax Consultant.

-

-

Senior-Level (6+ years)

-

Salary: INR 10,00,000 or more per year.

-

Common jobs: Finance Manager, Chief Accountant, Senior Auditor.

-

Job Roles and Salary in India

| Job Role | Salary Range (per year) |

| Accountant | INR 2,50,000 – 4,50,000 |

| Financial Analyst | INR 3,00,000 – 6,00,000 |

| Auditor | INR 3,50,000 – 5,50,000 |

| Tax Consultant | INR 4,00,000 – 7,00,000 |

| Finance Manager | INR 8,00,000 – 12,00,000 |

| Investment Banker | INR 10,00,000 – 20,00,000 |

A BCom Accounting degree helps students get high-paying jobs in finance. Experience and extra skills can increase salaries over time.

Future Scope of BCom Accounting Degree in India

A BCom Accounting degree opens many career paths. You can get jobs in both the government and the private sector.

It also gives you a chance to work abroad in big companies. So, let’s now look at the future scope of this course.

Jobs in Government & Private Sectors

- Government Sector

If you want to work in a safe and stable job, then the government is a good option.

- You can work in finance or audit departments.

- Job roles include government accountant, tax officer, or auditor.

- Moreover, government jobs offer job security, fixed salary, and even pension.

- Private Sector

On the other hand, the private sector gives many choices.

- You can work in banks, finance companies, or corporate offices.

- Some job roles are financial analyst, auditor, tax consultant, or even CFO.

- Because of their skills, companies trust BCom graduates to manage money wisely.

Jobs Abroad

- High Demand

In fact, many students dream of working in other countries. And with this degree, it is possible.

- Many foreign companies look for accounting professionals.

- You may find jobs in multinational companies, banks, or financial firms.

- Best Countries for Work

If you are aiming to go abroad, some countries are better than others.

- USA, UK, Canada, Australia, and UAE have many job openings.

- Also, these places offer high salaries for skilled professionals.

A BCom Accounting degree helps you get good jobs in India and other countries. Since this field is growing fast, it offers a safe, secure, and well-paid career. Therefore, it is a smart choice for your future.

Career and Job Opportunities after BCom Accounting Degree

After BCom Accounting, students can work in various job roles. These include finance, banking, auditing, and taxation. These jobs offer good salaries, career growth, and stability. Let’s look at top career choices.

Top Job Roles & Their Importance

-

Accountant

-

Keeps financial records and prepares financial reports.

-

Makes sure a company follows tax rules. It manages expenses with accuracy.

-

-

Financial Analyst

-

Studies financial data to help companies make better decisions.

-

Helps businesses invest and avoid financial risks.

-

-

Auditor

-

Checks financial records to make sure they are correct and legal.

-

They help companies follow government rules and prevent fraud.

-

-

Tax Consultant

-

Advises businesses and people on tax laws.

-

It helps you save money by organizing your taxes. You can file your returns without any hassle.

-

-

Finance Manager

-

Makes big financial decisions for a company.

-

Plans budgets, investments, and business growth strategies.

-

Government Job Options

-

Government Accountant

-

Works in Indian Audit and Accounts Service (IA&AS).

-

Manages public funds and checks government spending.

-

-

Tax Inspector

-

Works in Income Tax Department.

-

Checks if people and businesses are paying correct taxes.

-

-

Assistant Audit Officer

-

Works in government audit offices.

-

Helps in checking government accounts and finding financial mistakes.

-

Private Sector Job Options

-

Corporate Accountant

-

Manages company’s financial records and tax reports.

-

Ensures proper budgeting and cost control.

-

-

Financial Analyst

-

Analyzes money flow in companies.

-

Helps businesses make smart investment and saving plans.

-

-

Accounting Firm Consultant

-

Helps businesses with accounting and tax advice.

-

Provides guidance on financial planning and auditing.

-

A BCom Accounting degree leads to many job options. You can work in both private companies and government positions. It provides solid salaries and job stability in the growing finance sector.

Top Companies Hiring BCom Accounting Graduates

A BCom Accounting degree helps students get jobs in top companies. Many large companies need finance experts to help manage money, tax, and business accounts. Let’s explore some of the best companies that are hiring BCom graduates.

Top Hiring Companies & Their Focus Areas:

- Deloitte:

Deloitte is a global company that offers tax, audit, and consulting services. They hire graduates for finance management and risk analysis.

- PwC (PricewaterhouseCoopers):

PwC is a leading accounting firm hiring graduates. They have jobs in auditing, consulting, and tax services. PwC also offers training and global career opportunities.

- EY (Ernst & Young):

EY specializes in tax, advisory, and financial audits. They help businesses manage accounts and financial risks.

- KPMG:

KPMG is a top finance and accounting firm. They offer jobs in auditing, taxation, and advisory. KPMG focuses on financial reporting and business improvement.

- HDFC Bank:

HDFC Bank is one of India’s largest private banks. They have job openings in finance, risk management, and accounting. HDFC Bank provides roles in banking operations and customer finance solutions.

- ICICI Bank:

ICICI Bank is a leading Indian bank hiring graduates. They are looking for candidates in finance management and investment banking. ICICI offers roles in financial planning, credit analysis, and risk control.

- Tata Consultancy Services (TCS):

TCS is a worldwide company that provides IT and finance services. TCS has jobs in business accounting and financial technology. They help businesses with account management and financial data analysis.

- Reliance Industries:

Reliance Industries is a top Indian company that hires finance experts. They focus on budgeting and financial planning. Reliance offers careers in corporate finance and tax management.

- Axis Bank:

Axis Bank provides career options in banking, finance, and investment management. They help graduates build careers in financial operations.

Important Skills for BCom Accounting Degree

A BCom Accounting degree needs more than just good marks. Students must also learn some key skills. These skills help them do well in finance jobs.

Essential Skills & Why They Matter:

- Analytical Thinking:

This skill helps you understand financial reports. It is also useful for solving money problems. So, it helps in tax planning and making business decisions.

- Attention to Detail:

You need this skill to check financial data carefully. It is very important for finding mistakes in reports. Because of this, your reports will be accurate and clear.

- Communication Skills:

Sometimes, you must explain financial terms to others. So, good communication helps you talk to clients and team members. It also helps you write clear emails and reports.

- Ethical Judgment:

This means doing your work honestly and fairly. It is important for following business laws and avoiding fraud. Therefore, companies trust accountants who are honest.

- Time Management:

You need this to finish your work on time. It is useful when you are working on reports and tax filings. Moreover, it helps you manage many tasks at once.

- Problem-Solving Skills:

This helps you find mistakes in accounts. It also helps in fixing money problems. So, it supports smart financial decisions.

- Technical Skills:

You must know how to use accounting software like Tally, QuickBooks, and Excel. These tools are helpful in making financial statements and budgets.

- Teamwork:

Accountants often work with teams like sales and marketing. So, working well with others helps in planning business finances.

These skills help BCom students get good jobs in finance, banking, and business. So, if you build these skills, you can enjoy a bright and successful career in accounting.

Certificate Courses after BCom Accounting

A BCom Accounting degree is a great start for a career in finance and accounting. However, to get better job chances, students can also take extra certificate courses. These courses help improve skills and give more career options.

So, let us look at some of the best certificate courses after BCom Accounting.

Top Certificate Courses & Their Benefits

- Certified Public Accountant (CPA)

This is a global course that teaches advanced accounting and tax rules. It is helpful because it gives a chance to get high-paying jobs in auditing and finance.

- Chartered Financial Analyst (CFA)

This course is best for students who want to work in investment banking. It covers financial analysis, ethics, and economics. So, students learn how to work with money in smart ways.

- Financial Risk Manager (FRM)

This course focuses on risk management in banks and finance companies. It also helps students understand credit risks and market trends.

- Certified Management Accountant (CMA)

The CMA course teaches financial planning and business decision-making. Because of this, it helps students get jobs as finance managers or business analysts.

- GST Certification Course

This course teaches tax rules under India’s GST system. As a result, it helps students become tax consultants or accountants.

- Forensic Accounting and Fraud Detection (FAFD)

This course focuses on finding financial fraud and errors in accounts. Therefore, it is helpful in getting jobs in both government and private companies.

- Tally and Accounting Software Certification

This course teaches how to use Tally, QuickBooks, and other finance software. So, it helps students work in both small and big companies.

These certificate courses help BCom graduates gain extra skills. They also give a better chance of getting good jobs. By choosing the right course, students can build a strong career in finance and accounting.

BCom Accounting or BCom Finance – Which is Better?

Students who want a career in finance and business often choose between BCom Accounting and BCom Finance. Both courses have good job opportunities, but they focus on different skills. Let’s compare them to help you decide.

Advantages of BCom Accounting

1. More Career Options

- Covers accounting, taxation, and auditing.

- Helps students get jobs in banks, companies, and government offices.

2. Accepted Worldwide

- The degree is recognized in many countries.

- Good for students who want to work abroad.

3. Good for Professional Courses

- Helps in preparing for CA, CPA, and CMA exams.

- Many companies prefer BCom graduates for accounting jobs.

4. Government Job Opportunities

- Helps in getting jobs in tax, finance, and audit departments.

- Useful for exams like UPSC, SSC, and banking exams.

5. Easier for Students Who Don’t Like Maths

- Focuses on practical accounting rather than complex calculations.

- Good for students who like finance but not advanced maths.

Advantages of BCom Finance

1. Focus on Financial Management

- Teaches business finance, investments, and risk management.

- Helps in handling company funds and market trends.

2. Jobs in Banking and Investment

- Good for students who want jobs in banks, stock markets, and investment firms.

- Helps in roles like wealth management and financial planning.

3. More Corporate Jobs

- Preferred by big companies and international banks.

- Helps in roles like business finance and financial consulting.

4. Best for Higher Studies

- Helps in MBA in Finance or certifications like CFA and FRM.

- Good for students who want to study more and specialize.

5. Good for Stock Market Careers

- Covers investment strategies and financial modeling.

- Useful for students interested in trading and financial analysis.

Read More: BCom Finance Degree: Course, Scope, Salary, Career, Job and More

Which One Should You Choose?

- Choose BCom Accounting if you want jobs in accounting, taxation, auditing, or government finance.

- Choose BCom Finance if you want jobs in banks, stock markets, investment firms, or corporate finance.

Both courses offer great career options. Pick the one that matches your skills and future goals.

How to Choose a Top BCom Accounting College?

Choosing the right BCom Accounting College is very important. It helps you get a good education and better job options later.

To make a smart choice, you should look at some key points. These tips will help you pick the best college for your future.

- Accreditation and Affiliation

First of all, check if the college is approved by UGC, AICTE, or NAAC. Also, it should be affiliated with a well-known university. This makes sure that you get a high-quality education.

- Experienced Teachers

Next, find out if the college has good teachers. They should be qualified and have experience in teaching. Moreover, teachers with real industry knowledge can help you learn practical accounting skills.

- Good Infrastructure

The college should also have modern classrooms, a large library, and computer labs. Because of this, students can learn better in a comfortable environment.

- Placement Support

A good college always helps students get jobs in top companies. So, check the placement records and find out which companies visit the college every year.

- Strong Alumni Network

If the college has a strong alumni group, it can be very helpful. Many times, former students can guide you and give you job referrals.

- Industry Exposure

Always choose a college that offers internships, guest lectures, and industry visits. This gives you real-world experience, even before you graduate.

- Affordable Fees and Scholarships

Not all students can pay high fees. So, look for colleges that have reasonable fees. Also, some colleges offer scholarships and financial aid to help students.

- Special Courses and Certifications

Some colleges offer extra certificate courses in finance and accounting. Because of these extra skills, you can get better jobs after graduation.

By checking all these points, you can find the best BCom Accounting college in India.

Top Colleges in India for BCom Accounting

There are many top colleges in India that offer BCom Accounting courses. These colleges not only provide quality education but also have skilled teachers. Moreover, they help students get good job options after graduation.

Let’s now look at some of the best colleges for BCom Accounting in India.

- St. Xavier’s College, Mumbai

St. Xavier’s is famous for its excellent teaching. In addition, it has a strong alumni network. The college offers a beautiful campus and great learning tools.

- Loyola College, Chennai

Loyola College builds a strong base in accounting and finance. It has good teachers and offers high placement rates. As a result, students get ready for jobs.

- Christ University, Bangalore

Christ University uses modern teaching methods. Also, students get real industry exposure. They even get internship chances in top companies.

- Hindu College, Delhi

Hindu College is a well-known college for commerce. It has expert teachers. Besides, it gives good career advice and great placements.

- Narsee Monjee College of Commerce and Economics, Mumbai

This college is famous for commerce education. It has links with industries and offers practical learning. Moreover, it has top-class teachers.

- Madras Christian College (MCC), Chennai

MCC has a great learning environment. It has skilled teachers who help students gain strong finance skills. Because of this, many students succeed after college.

- Symbiosis College of Arts and Commerce, Pune

Symbiosis gives high-quality education. Also, it offers good internship programs. The college has strong industry ties, which help students.

- Hansraj College, Delhi

Hansraj is known for its experienced faculty. It also offers career support and job training. In fact, it focuses more on practical accounting skills.

- Mount Carmel College, Bangalore

Mount Carmel uses modern teaching styles. It offers skill-based learning. Additionally, it has a great campus and good placements.

Choosing the Right College

When you choose a BCom Accounting college, you must look at a few things. Make sure the college has good teachers, strong placements, and real-world learning. Because of these features, a top college will help you build a strong career in finance and accounting.

Frequently Asked Questions (FAQs):

Find some common questions people search about BCom Accounting:

BCom Accounting is a three-year course. It teaches about finance, taxes, and business accounts. So, it is great for students who like numbers.

The subjects include financial accounting, taxation, and auditing. You will also learn business law and economics. Therefore, you get full knowledge about business.

After this course, you can work as an accountant, auditor, or tax consultant. You may also become a financial analyst. So, there are many choices.

It depends on your interest. BCom Accounting is better for finance jobs, while BBA is better for management roles. So, choose based on your goal.

The starting salary is around ₹3 to ₹6 lakh per year. However, this depends on your job and company.

Top colleges are SRCC, St. Xavier’s, Christ University, and Loyola College. So, these are great choices for students.

Yes, you can. In fact, BCom Accounting is a good base to become a Chartered Accountant (CA). It helps you understand finance better.

After this course, you can study MCom, MBA, CA, CMA, or CFA. So, there are many ways to continue learning.

Yes, it does. But the math is simple. It includes basic statistics and financial calculations.

No, it is not hard. If you like numbers and have interest in finance, then it is easy to learn.

Key Takeaway

BCom Accounting opens up many career opportunities. Therefore, choosing the right college is very important.

A good college gives you the right education. It helps you build strong skills and brings better job options.

So, always pick a college that has good teachers, nice classrooms, and strong job placements. Moreover, focus on learning by doing. Try to get real-world experience, as it helps you understand things better.

Along with that, you can also think about doing extra certificate courses. These will make your resume stronger. A good college will always help you get ready for a bright future in accounting and finance.

In the end, take your time. First, do good research. Then, choose the best college for a successful career.